Federal Reserve Updates to Main Street Lending Program and Status of Loans to Nonprofits

On June 8, 2020, the Board of Governors of the Federal Reserve System (the “FRB”) issued a press release together with updated Term Sheets and Frequently Asked Questions for the Main Street Lending Program (the “MSLP”). The updated Term Sheets for the Main Street New Loan Facility (the “MSNLF”), the Main Street Priority Loan Facility (the “MSPLF”), and the Main Street Expanded Loan Facility (the “MSELF”) expand the MSLP in order to allow for a broader range of small and medium-sized businesses to be able to take advantage of the program.

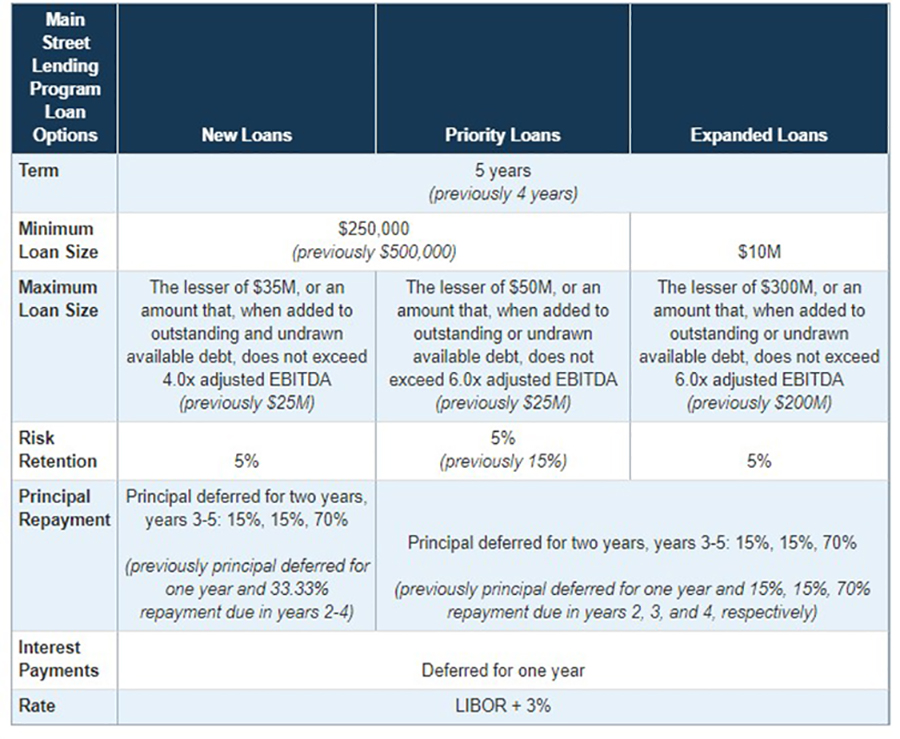

The changes the FRB made to the facilities include:

- lowering the minimum loan size for the MSNLF and MSPLF to $250,000 from $500,000;

- increasing the maximum loan size for all facilities;

- increasing the term of the loans for each facility to five years, from four years;

- extending the repayment period for all loans by delaying principal payments for two years, rather than one, with interest payments commencing after the first year (either monthly or quarterly (based upon the terms agreed upon with an eligible lender)); and

- raising the FRB’s participation to 95% for all loans.

Updated Material Terms

The chart below provides a more detailed description of these changes.

Source: Federal Reserve Board (FRB)

Loans Funded Pursuant to Legacy Term Sheets

These updated terms will not disqualify a loan which has already been originated under the previous terms from being purchased by the FRB’s Special Purpose Vehicle (the “SPV”). In their press release, the FRB clarified that the SPV will accept loans originated under the previous terms so long as such loans were funded prior to June 10, 2020.

Timing for MSLP to Commence Purchases

The FRB stated that they expect the MSLP to be open for lender registration soon and that the FRB will begin actively buying loans shortly after the lender registration is opened. We will continue to provide you with updates on the status of the MSLP as they become available.

Update on Loans to Nonprofits

The FRB also announced on June 8, 2020 that it is working to establish a program soon for nonprofit organizations.

On June 8, 2020, the Board of Governors of the Federal Reserve System (the “FRB”) issued a press release together with updated Term Sheets and Frequently Asked Questions for the Main Street Lending Program (the “MSLP”). The updated Term Sheets for the Main Street New Loan Facility (the “MSNLF”), the Main Street Priority Loan Facility (the “MSPLF”), and the Main Street Expanded Loan Facility (the “MSELF”) expand the MSLP in order to allow for a broader range of small and medium-sized businesses to be able to take advantage of the program.

The changes the FRB made to the facilities include:

- lowering the minimum loan size for the MSNLF and MSPLF to $250,000 from $500,000;

- increasing the maximum loan size for all facilities;

- increasing the term of the loans for each facility to five years, from four years;

- extending the repayment period for all loans by delaying principal payments for two years, rather than one, with interest payments commencing after the first year (either monthly or quarterly (based upon the terms agreed upon with an eligible lender)); and

- raising the FRB’s participation to 95% for all loans.

Updated Material Terms

The chart below provides a more detailed description of these changes.

Source: Federal Reserve Board (FRB)

Loans Funded Pursuant to Legacy Term Sheets

These updated terms will not disqualify a loan which has already been originated under the previous terms from being purchased by the FRB’s Special Purpose Vehicle (the “SPV”). In their press release, the FRB clarified that the SPV will accept loans originated under the previous terms so long as such loans were funded prior to June 10, 2020.

Timing for MSLP to Commence Purchases

The FRB stated that they expect the MSLP to be open for lender registration soon and that the FRB will begin actively buying loans shortly after the lender registration is opened. We will continue to provide you with updates on the status of the MSLP as they become available.

Update on Loans to Nonprofits

The FRB also announced on June 8, 2020 that it is working to establish a program soon for nonprofit organizations.