Friendly Foreclosure Sales and Other Alternatives to Traditional Chapter 11 Restructurings

In a traditional chapter 11 case, a company in financial distress utilizes the tools provided by the Bankruptcy Code to restructure both its business and its balance sheet, and it emerges under a chapter 11 plan as a going concern. Sophisticated players, however, have become concerned that the uncertainties, costs and delays inherent in chapter 11 (especially in light of additional burdens imposed by the 2005 amendments to the Bankruptcy Code), undermine reorganization prospects and erode recoveries. Thus, parties have been exploring alternative methods to sell or restructure viable businesses in an attempt to avoid the vagaries of the chapter 11 plan confirmation process. Because chapter 11 provides procedural safeguards for all constituencies, parties seeking to wipe out junior classes of secured lenders who appear to be out of the money may prefer an alternative mechanism such as a foreclosure sale, rather than a risky and expensive cramdown battle. The uncertainty, delays and expense of chapter 11 may also have adverse consequences for the viability of the business, as suppliers, customers, employees and other important constituencies lose faith in the company’s ability to survive. Alternative mechanisms may achieve the desired result quicker, with more certainty and with less expense.

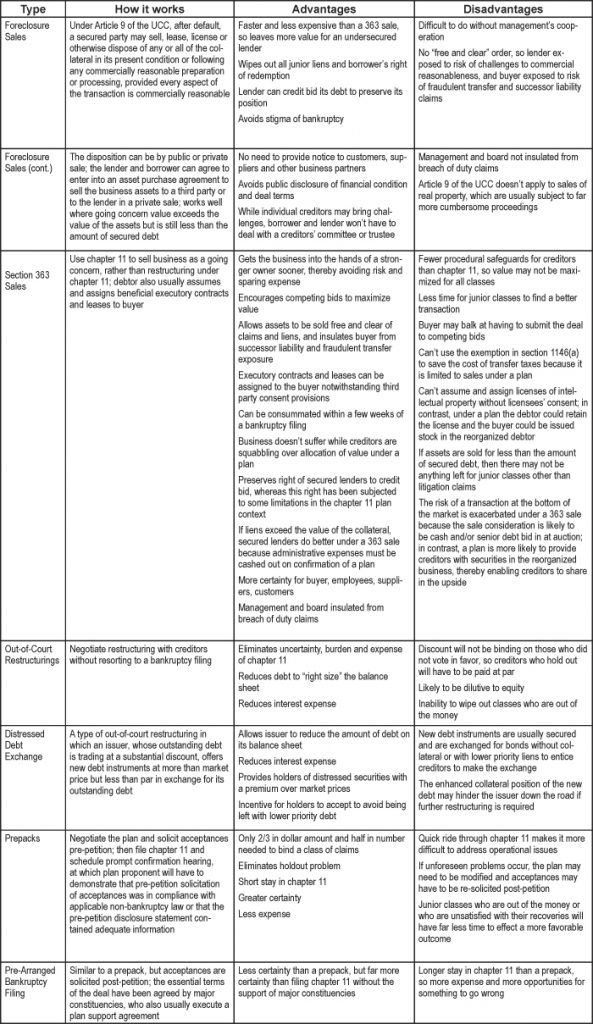

Historically, the most popular alternatives to a traditional chapter 11 have been out-of-court restructurings, distressed debt exchanges, prepackaged bankruptcy filings (referred to as “prepacks”), pre-arranged or pre-negotiated bankruptcy filings and section 363 sales. A sixth method that has been under-utilized but may be worth consideration is the “friendly” foreclosure sale. A friendly foreclosure sale entails an agreement among the borrower, senior lender and a buyer pursuant to which the lender will foreclose its liens and transfer its collateral – the assets comprising the business – to the buyer with the cooperation of management. This works so long as the collateral consists entirely of personal property (i.e., everything other than real estate owned by the borrower), so that the lender can utilize the streamlined foreclosure procedures under Article 9 of the Uniform Commercial Code.1 The optimum situation for use of a friendly foreclosure sale is where there is a significant amount of junior lien debt that appears to be out of the money, which can be wiped out with minimal risk of litigation claims alleging commercial unreasonableness, fraudulent transfer, successor liability, breach of fiduciary duty, etc.

This article will compare a friendly foreclosure sale to its closest relative – the section 363 sale – as well as four other alternative methods for restructuring a business in financial distress. Broadly speaking, any of the three alternatives that do not involve a bankruptcy filing entail forsaking the benefits of bankruptcy in exchange for avoiding the burdens associated with a bankruptcy. These bankruptcy benefits include the automatic stay, the ability to bind dissenting classes of debt and equity, insulation of any buyer or funder from attacks by creditors, insulation of management and the board from breach of fiduciary duty claims, and other bankruptcy powers and rights. The disadvantages of bankruptcy include the necessity for court approval, uncertainty, public disclosure, delay, valuation fights, the possibility of being held up by constituencies who are out of the money, and extra expense. Bankruptcy also increases the odds that insiders will be investigated and possibly sued. Each of the alternatives to a traditional chapter 11 restructuring presents its own set of advantages and disadvantages for the various constituencies,2 which can be summarized as follows:

Conclusion

As adverse economic conditions continue to take their toll on corporate America, companies will continue to encounter financial distress and need to restructure. In connection with plan confirmation, senior creditors may have to provide some recovery to constituencies who are out of the money to avoid a costly valuation fight. Therefore, troubled companies and lenders concerned with the uncertainties, costs and delays inherent in chapter 11 may wish to consider the six alternatives to a traditional restructuring discussed above, including the under-utilized friendly foreclosure sale. Obviously, which of these alternatives works best will depend on the particular situation, the value and nature of the borrower’s assets, the borrower’s capital structure, business prospects, industry, whether creditors will cooperate or hold out, whether the borrower merely needs to fix its balance sheet or also needs to address operational issues, economic conditions, the state of the capital markets, tax and securities law considerations, and many other factors. Nevertheless, there will be times when one of these alternatives may be superior to a traditional restructuring under chapter 11.

For More Information

For more information on how these issues may affect your rights, contact Nicholas F. Kajon at 212.537.0403.

This News Alert has been prepared for informational purposes only and should not be construed as, and does not constitute, legal advice on any specific matter. For more information, please see the disclaimer.

1 UCC § 9-610.

2 The columns headed “Advantages” and “Disadvantages” are to some extent arbitrary because an advantage for one or more constituencies may be a disadvantage for other constituencies. For example, the requirement of competitive bidding in connection with a 363 sale is beneficial to junior classes, but will not be popular with the buyer, who might prefer a private sale under Article 9 all other things being equal.